— Rep. Andrew Murr —

Sept. 13, 2017

Rep. Andrew Murr, of Junction, joined the Rotary Club of Kerrville for a guest talk on

Sept. 13 at the Inn of the Hills.

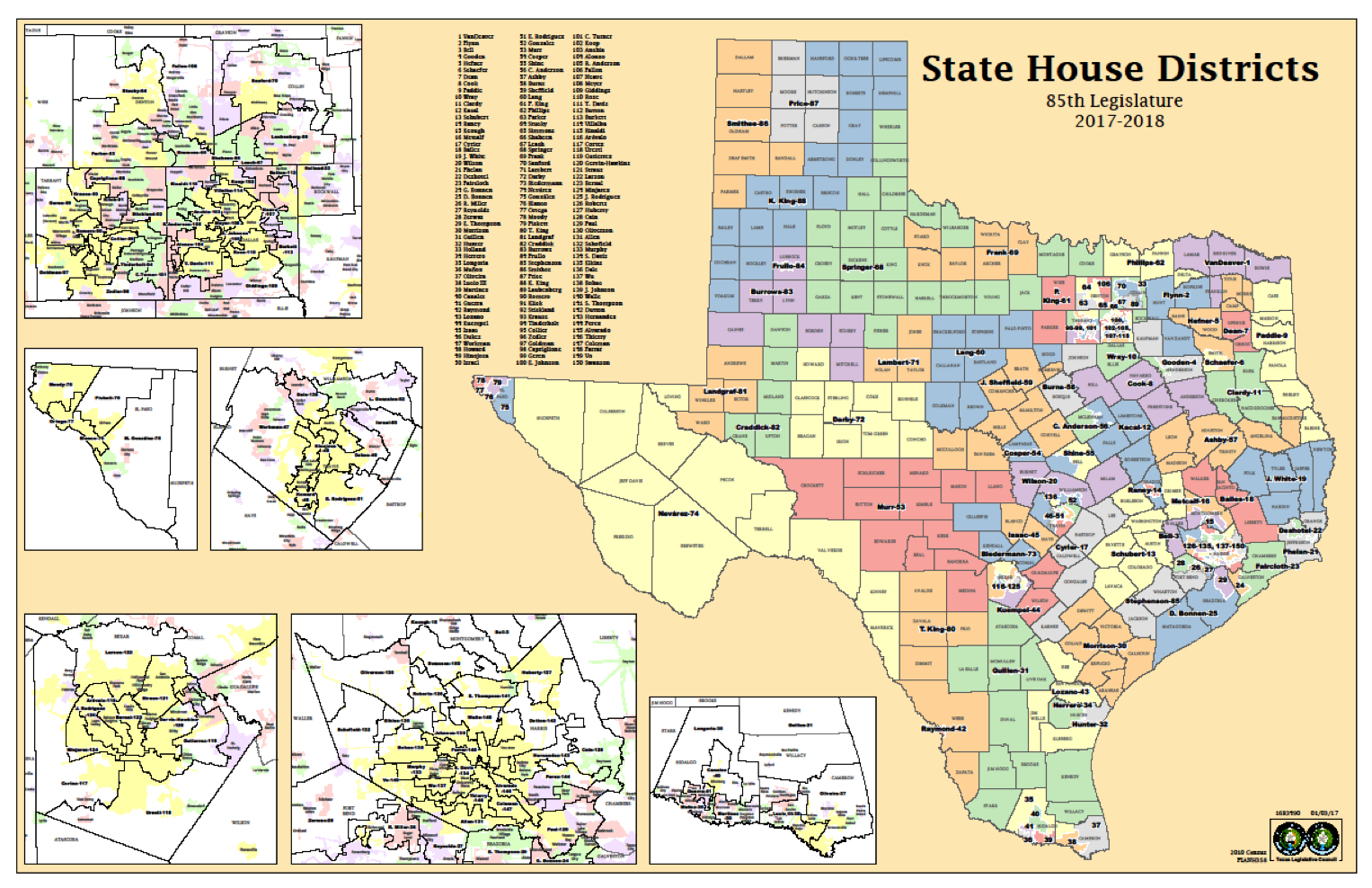

There are 150 members in the Texas House. If you'll look here, our district- they all have the same population - about 170,000 people.

Well, it takes us 12 counties to get to that.

Our district is in red in the following map.

We have about 15,000 square miles

— our district is larger than 9 states.

"The benefit is, I want to put something into perspective for you when we talk policy," Murr said.

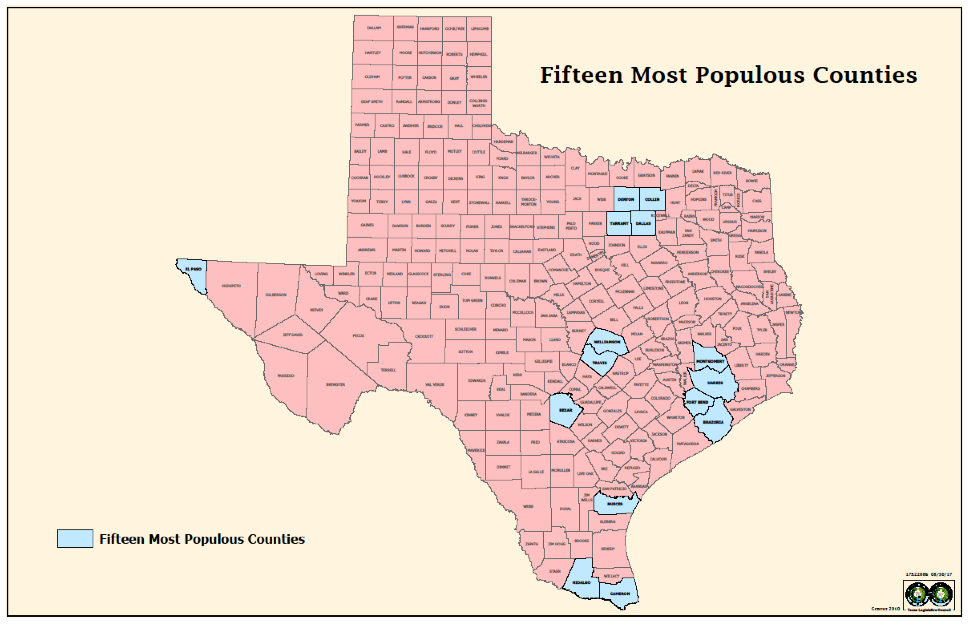

"So, I sat down with a colleague one day and we counted the 15 most

populous counties in the state," Murr said.

"In the 15 most populous counties in the state,

100 of the 150 House members reside and represent."

"So, what that leaves is 239 counties represented

by one-third of the Texas House."

"I guess what I'm trying to say is that there's actually a growing divide between urban and rural, and we have to keep cognizant of that whenever we are talking about politics and policy and what's best for one part of the state doesn't necessarily measure up to what's best for where we live. In doing that, I always strive to build strong relationships. Just as what you do here in the community. You want to get to know your neighbors — the people you do business with and the people you associate with."

He explained that he uses those relationships to form open communications with representatives from other districts, in order to look out

for the interests of the Hill Country.

"I give that, because it applies in Rotary, it applies

in our business and it applies in Austin."

The Texas Legislature meets 140 days every 2 years.

From January to the end of May was

the recent session.

They also had a special session, which only the governor can call. He also decides when the 30-day special session will be and

what business will be discussed.

One of the items of focus the governor

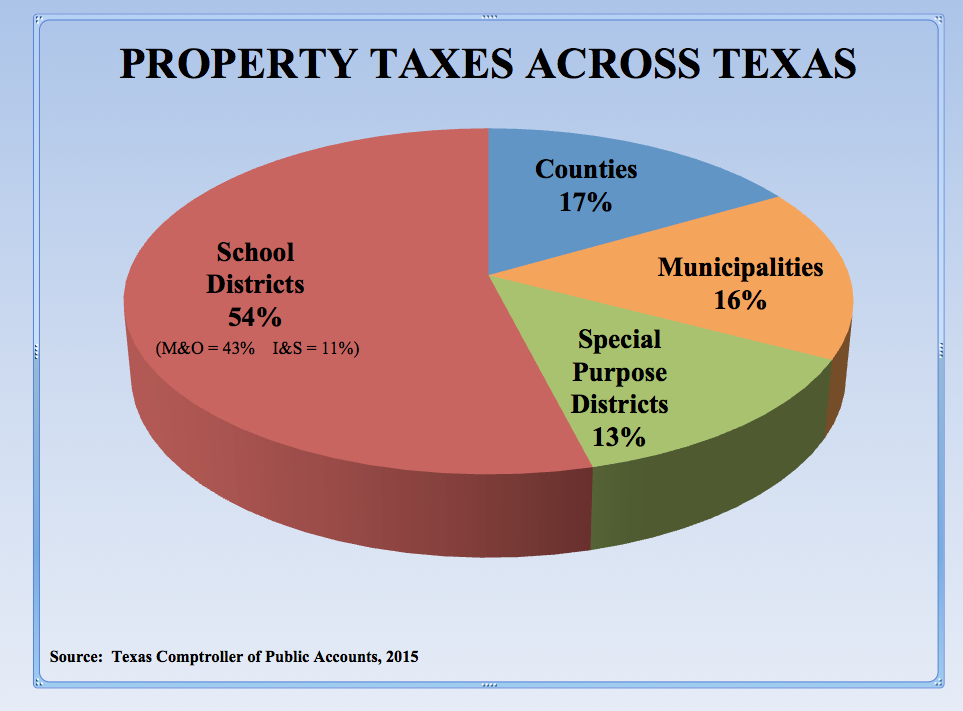

emphasized was property taxes.

"You all will agree, for the most part, that property taxes play a very important role in what we do,"

Murr said.

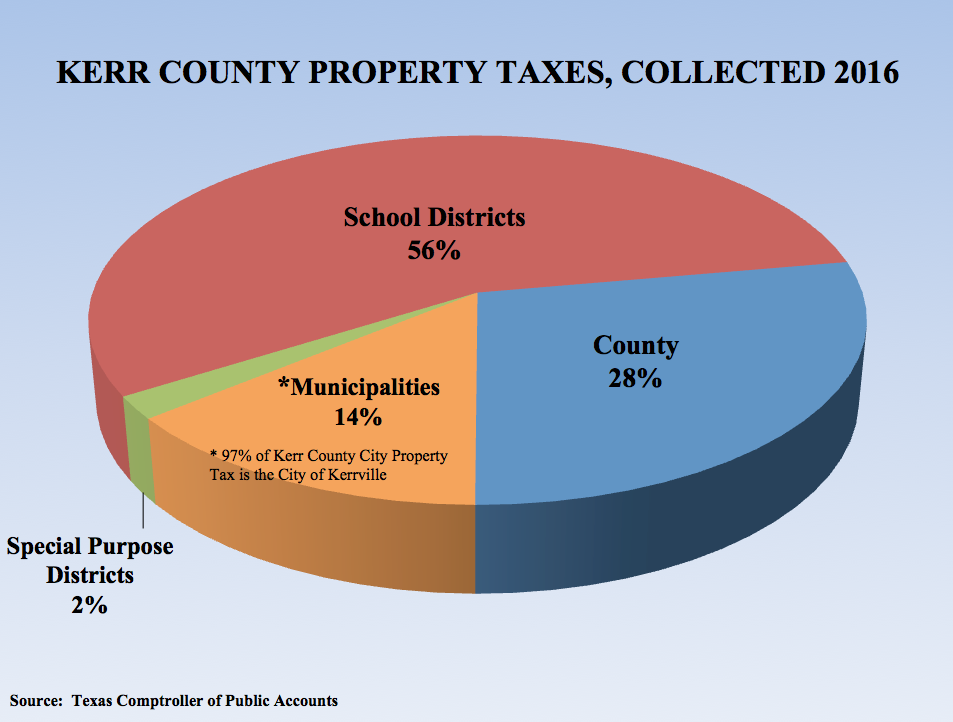

In Texas, when you get billed for property taxes next month, you will see that the majority of the Texans in the state pay more toward

supporting public education than anything else.

Then, we also pay our county taxes, our city taxes. And, then you have

special purpose districts, which vary across the state.

"I wanted you to put that into perspective

in how that works," Murr said.

"In the Texas Constitution, the state is prohibited from collecting property taxes. It's only done at the local level, and that's very important to keep in mind. So, when someone says 'Hey, State of Texas, can you do something about my property taxes?' the answer is 'Well, indirectly, because directly it is all collected at the local level."

"But, there's one thing in the Texas Constitution,

and that is how we pay schools," Murr said.

In Kerr County, on average,

of every $1 that gets collected, 56 cents

goes to schools.

"We're kind of mad, because we pay taxes, and if you live in some school districts, your money goes somewhere else. At the same time, your school district — rightly so — complains, sometimes, they don't have enough funds to do certain things. That's where we start talking about what the state can do."

There was talk about a rollback tax rate.

The Texas Legislature talked about reducing

the percentage before a county has to face a rollback.

"It doesn't put any of this back in your pocket, and that's where a lot of people get frustrated. They were labeling it 'property tax relief.' Now, I will ask a lot of you what you think relief is. Is relief giving you some of this (money) to put back in your pocket? That's what most people I talk to think. But, changing the rollback tax rate doesn't change the pile of money on the table.

What it does do is it changes the way local government

goes about budgeting itself," Murr continued.

"At the end of the day, the House and Senate did not

agree on language, so no change has occurred yet.

I know it'll be addressed in the future."

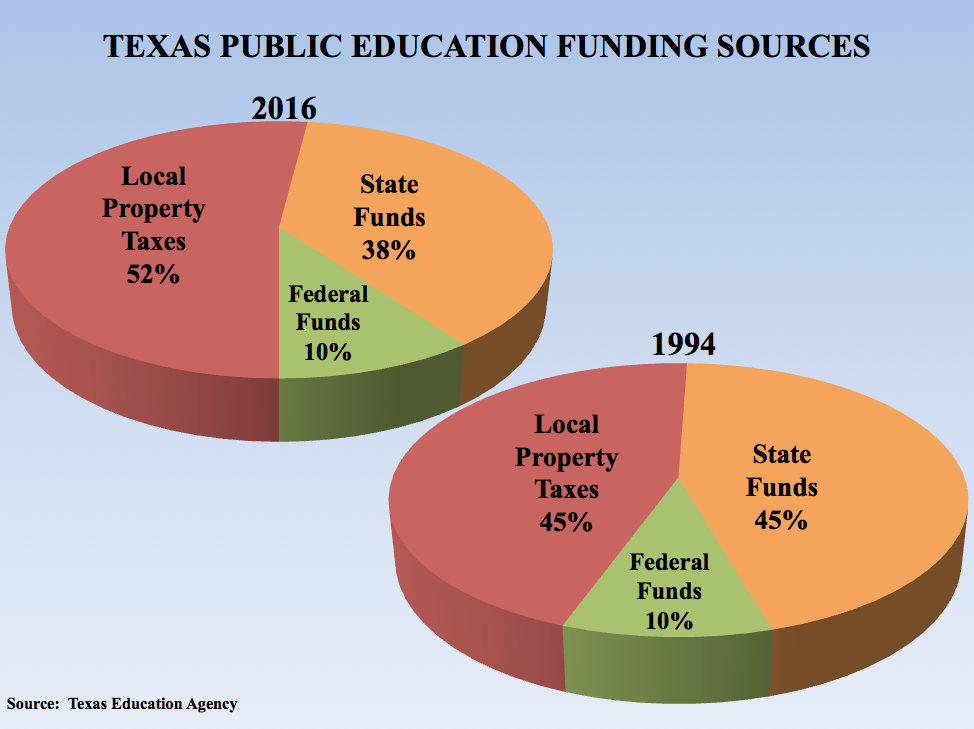

"When we study the pie chart, it is so obvious that, at the local level, we're paying a lot of money toward schools. Let's talk about school funding for a moment, because that's where I thought maybe we ought to give the attention. The State of Texas and the Constitution provides that the state will pay for a free and public education for our youth. That's the one area that the State of Texas could step up and do something."

In 1994, in the last big revamp of public education, that's when Texas started "Robinhood." Initially, the state paid about half and the local government taxes paid about half toward public education.

"If you advance forward almost a quarter of a century, you can see that the state pays less of its share and WE — everybody in this room —are now

paying a greater share, and that's going to continue," Murr said.

With public frustrations mounting in regard to funding education and property taxes, Murr said he decided to file a bill that proposed abolishing the property taxes collected for school districts, and, offset that by increasing sales taxes statewide to 12%.

"I fully anticipate that, after the hours of testimony we had in hearings, that this will be revisited."

"I can tell you that there is no advocacy for having a state income tax. The Constitution prohibits, just like a state property tax, and you'll never have traction to change that — at least not while all of us are alive."